Every organisation should report transparent on their risks and their control in order to be accountable to society and stakeholders, which is also prescribed in the Governance Code. An organisation must report on the risks it faces and the system in place for managing those risks, including tax risks. Is your organisation adequately informed about ongoing tax risks and do you have a system that allows you to control these risks? Are you able to account for the choices you have made? A TCF can provide useful insight into this.

What is a Tax Control Framework?

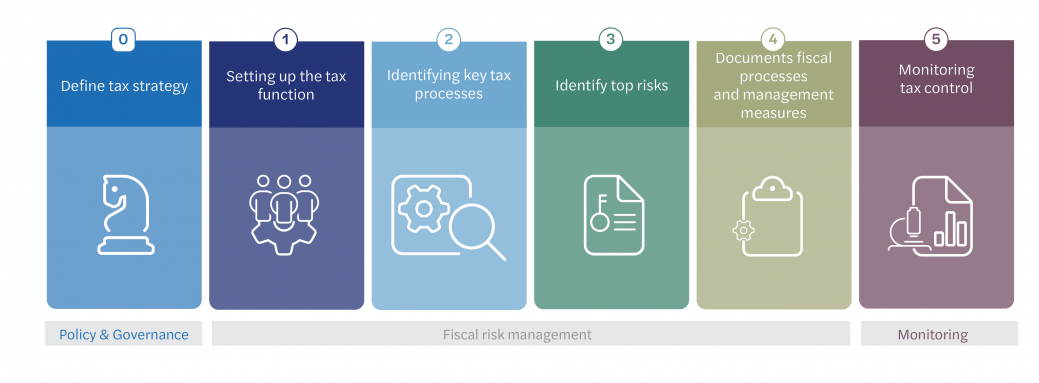

The set of policies, procedures and measures to identify, manage and mitigate tax risks within an organisation is called a TCF. This framework is comprehensive and is applied at both strategic and operational levels.

Tax strategy

An organisation should always have a tax strategy. Such a strategy defines how the organisation and/or management wishes to deal with tax issues. This even facilitates the company to make tax choices correctly, including the lower levels within the company.

Setting up the tax function

Assigned duties and responsibilities and the availability of sufficient knowledge regarding tax processes is important to any organisation. The ‘Set up tax function’ step in the TCF involves identifying which employees participate in the tax processes and what their duties are. In addition, you describe the setup of the supporting systems and databases. Consider employee education and training and assess whether sufficient resources are available to set up and run a good TCF.

For tax control, an allocation of responsibilities is important. It should be stated which employees and departments of the organisation have responsibility for tax matters.

Process descriptions

To be able to identify tax risk, it is necessary to have an overview of the processes in the organisation that affect taxation. When a description of these processes is made, it is immediately possible to see where in the process a possible tax risk occurs. These risks are then included in the control measures.

Risk analysis

This step involves identifying the organisation’s tax risks. It is important to have a clear tax risk profile, identifying the top risks, so that your organisation can act on these risks proactively. This step is therefore considered the most important, but also the most difficult. Risks can occur in the processes described in an earlier step, but they can also arise from the nature of the organisation or the market in which it operates. Control measures are then defined for the most important risks so that these risks can be mitigated.

Monitoring tax control

The last step in the framework concerns monitoring. It is important to establish periodically that the framework and defined control measures are working properly and accurately capturing the organisation’s risks. This monitoring will often consist of (statistical) sample review, but other means of control can also be used for this purpose. An improvement plan may follow from the monitoring findings to further optimise the TCF and mitigate any additional risks.

Mazars can help

In each of these areas, your organisation will need to think about how you want to shape the TCF. For example, the question arises as to what tax strategy you want to adopt. Gaining as much tax benefit as possible, or does the organisation want to be compliant, putting its relationship with the tax authorities first? And how is this strategy then propagated by the organisation in its day-to-day activities? Who participates in the tax processes, and what are the relevant tax processes ? Is our organisation capable of recognising all tax risks, and can we answer why we do not manage some risks? These are some of the questions that will come up during the set-up of a TCF and which we would be happy to help you with.

International approach

Organisations with branches in multiple countries may want a uniform approach for each firm so that tax control can also take place in a uniform manner. This naturally takes into account the requirements in the individual countries. Mazars has developed an international approach whereby a tax control framework is implemented in the same way in each country. Mazars has specialists in various countries who can advise you on an international tax control framework. Please refer to the video below to find out more about this.

Want to know more?

Are you curious about your options in this area, or do you have specific questions about the Tax Control Framework? Then please contact Martin Aandewiel by e-mail or phone: +31 (0)88 277 13 96 or Menno van Werkhoven by e-mail or phone: +31 (0)88 277 18 12. They will be happy to help you.